By Adama Wade*

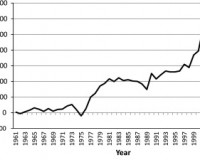

It was in 2007-2008, a year before the Black September when the American bank, Lehman Brothers, filed for bankruptcy. The price of a tonne of rice which was USD 219 in 2006, rose from USD 400 to a record high of USD 1,000 within the space of four months due to speculation by producers, but also, noted a trader strategically located on the Geneva Square, the embargo on rice exports from India (imposed to contain its own domestic inflation), Brazil and China. The situation was compounded by the floor price which was increased on weekly basis by the Vietnamese Government. All this was taking place in the context of panic and large-scale buying by the Philippines.

This was all it took for the price of 100% broken rice, the staple food in Senegal, to reach an all-time high, leading to food riots and forcing the political powers to support the purchasing power through costly interventions (the removal of VAT for several years, plus the suspension of customs duties and indirect subsidies) which proved ineffective in the face of soaring prices. Obviously, a 10% decrease in customs duties could not curb the 60% price increase.

In the case of Senegal, the direct subsidy of CFA F 5.3 billion, the capping of distributors’ profit margins and the introduction of a hotline service for consumers to whistle blow on traders who were not complying with the decreed prices, instead resulted in a showdown with the Government, with no significant impact on the final price. At the height of the crisis, the Government supported some importers with a view to reducing the tension between supply and demand, but failed to restore the pre-crisis prices. Where are we today?

Five years after the 2007 debacle, our African countries, which import 10 million tonnes of rice per year*, seem aware of the dangers of dependence in a context where the prized food commodity has still not attained its previous threshold in 2006 (USD 219/tonne). How, in that context, can we not fear further sharp price hikes, yet China has structurally become a rice importer?

Although this is an important debate in West Africa, little has changed on the ground. Nigeria, which ordered the end of the imports by 2015, was still ranked the second net buyer of rice in 2012. Senegal, with 13 million inhabitants, is the world’s tenth biggest importer with 700,000 to 900,000 tonnes per year. Why has this dependence persisted after the 2007/2008 crisis? Is it the superpower local lobby groups together with foreign interests or the lack of political will on the part of our leaders?

The long import chain, which rakes in huge profits every year, today still has actors beginning with Southeast Asian producers, followed by their cooperatives through international traders and, ultimately, the so-called Senegalese importers, who too often buy the commodity delivered to the port through a third party with a bank security. «Those who control the process are neither in Thailand nor in Senegal, but in Geneva and in major foreign markets », points out a broker from the Geneva-based Global Advisory Services.

A former employee of Louis Dreyfus who now deals in rice production in West Africa states that «Africa is a spot market » which, according to him, is a manifestation of the lack of organisation among importing countries. « You say that Senegal is the world’s tenth largest importer of rice. It’s like saying that Africa is the fifth global economy. This is an aggregate figure that has no basis considering that we have many small rice buyers with low negotiating power against big traders and well-structured South Asian cooperatives supported by their Governments.

Rice, a High-Risk Market

Since West African import markets are not organised, traders and other stakeholders can use their relative weight to their advantage in relation to their partners. «The African market is easy to predict, as it dependent on the population, stock levels and rainfall. But it is a high-risk market,» adds our source who wishes to remain anonymous.

Traders who forward-buy minimise their risks by using the information at their disposal. The competition is such that the most astute traders load their ships and select two optional countries as landing locations. The rest is all about opportunities resulting from trends and trend reversals. African importers buy the cargo on board once they get the green light from their banks (letters of credit), and often through a third party. The number of the parameters used by the trader right to the floating vessel (trends in chartering of vessels, global and local rice prices, fuel prices, etc.) makes rice trade a very risky, high-yield market. However, the London broker asserts, « It will be short-lived».

No Feeders of World Renown

All the big names have left or distanced themselves from this trade including Cargill, the world’s largest trader. The reputation of a high-risk market characterised by challenges has pushed away reference feeders on the one hand, and made experienced specialists and unscrupulous traders thrive. Those who are successful in this business have combined the trading with production. A case in point is Bagastani (CIC), one of the best experts in the African market, a man with 50 years of experience in rice trade who is synonymous to Amajaro in the cocoa industry. It was impossible to get this trading bible to speak confirming that in this business, mum is the word.

«African markets are crystallised, and therefore increased competition would significantly contribute to preventing consumers from being taken hostage by a few names that call the shots,» affirm the Geneva players. Meanwhile, the lack of planning of imports has become the bread and butter for intermediaries. «If an African country decides to impose a buffer stock scheme on players (Egypt’s case with wheat), the changes in the prices of rice will be better controlled. Our margins would be affected,» we are told in confidence.

Currently, this is not the case in Senegal where the Government has introduced a 3% levy (Article 220 of the Tax Code) on importers with less than CFAF 1 billion turnover as a tax advance on commercial and industrial profits to discourage the fragmentation of players. «In our opinion, such a move will increase the cost of rice for consumers. The importer tends to pass on the 3 % levy to the cost structure», warns Ousmane Sy Ndiaye, the Chairman of the Senegalese National Union of Traders and Industrialists (UNACOIS). Incidentally, UNACOIS has just launched a central purchasing body worth CFAF 100 million.

The Central Purchasing Body: An Effective Solution

The traders’ margin complements that of the exports cooperative. These building blocks of the cost structure are added to the bank’s financial costs, port passage and freight costs. Nevertheless, African countries that have privatised their ports or sold their commercial fleets, have no control over the value chain at the port and even less on the market. Also, the emergency mechanism often used by our Governments to lower prices consists of removing VAT and customs duties, subsidising imported products with no assurance of success. Wouldn’t the best way to lower prices comprise reviewing the entire value chain structure?

By establishing a well-structured central purchasing body and reorganising our ports (among the most expensive in the world), the financial costs would be optimised (obtaining funding and opening letters of credit at better rates) and we could negotiate directly with import cooperatives (15% to 30% savings). The central purchasing body facilitates stock management, the quality control of products supplied, the monitoring of the country’s needs using commodity purchase financial instruments (options and futures markets) and the mobilisation of resources. The Zambian Government mobilised hundreds of millions of dollars on the basis of its stocks and consumption forecasts. Senegal could do the same by opting for bulk purchases through a public- private partnership process.

The Government would succeed in making savings without eliminating VAT and customs duties. The amounts thus generated will be channelled to strengthening local production that is today being sacrificed. « It is strange that the rice produced in central Vietnam, transported to Ho Chi Min Port, loaded in bulk and shipped to the ports of Abidjan or Dakar, landed and then transported by road to Bobo Dioulasso or St. Louis is preferred by the population and is cheaper than local rice», wonders aloud an operator, formerly shareholder of Glencore International.

Local African Production, the Way Forward

Can local production in Senegal be profitable? Is it possible to reverse the preference for imported rice which is a bottleneck to local production? The answer to the first question is simple. All the studies conducted (see table) on yields per hectare and production costs rank Senegal among the most competitive producer countries, albeit in a context characterised by high energy prices. As for the second question (the preference for imported rice), it depends on lifestyles and habits perpetuated by persistent prejudices regarding local rice. Although modern rice mills today can process paddy rice under the same conditions as the Thai or Vietnamese rice, offering a range of quality based on one’s purchasing power, local rice remains relegated to a by-product, especially in Dakar.

Inconsistencies in Local Production

Local production accounts for 200,000 tonnes of paddy rice, the equivalent of 140,000 tonnes of local rice. The Government’s goal is to reach 1 million tonnes by 2015, including 800,000 tonnes produced through irrigated rice. The Senegalese Government has made food self-sufficiency its key priority. But, there are still some inconsistencies. More tax incentives are given to investors who make 80% of their turnover from exports. Amazing! This is just the tip of the iceberg- while Asian producers receive subsidies on energy, water and fertilizers, in the Senegal River Valley, support mechanisms remain elusive. So, there are no energy subsidies for rice production and development (offset). Urea, which was subsidised by 50% between 2006 and 2011 and sold at CFAF 6,000 now costs CFAF 9,000. Although the price of DAP actually decreased, the quantity available barely covers half of the requirements. There is an energy challenge in the processing of local rice.«There are fixed monthly electricity costs. Whether you work or not, you pay CFAF 250,000 a month.» Under such conditions, can local rice sold at CFA 12,500 mill price (12,500 for whole grain rice) be competitive and generate enough income for a quantitative and qualitative leap?

BOX

Measures to Break Dependence

-The establishment of a central purchasing body, managed by the private sector, but regulated by the Government, can enable a country to plan its procurement, have greater negotiating powers with suppliers, control quality and benefit from various financing mechanisms denominated in stocks and future consumption. For Senegal, this would shorten the supply chain, ensure there is a buffer stock (to cushion the sector from external shocks) and harmonise the prices throughout the country. The effectiveness of the system involves the comprehensive reform of the logistics chain in order to reduce port transit and delivery times.

– Incentives for local production and processing, with appropriate taxation and well-researched support mechanisms (energy, fertilisers and nutrients) would be likely to increase production and, ultimately, contribute to maintaining the country’s balance of payments.

5 commentaires

Hi,

I am INDIAN based RICE exporter and dealing with this commodity for last 30 years. I can supply you the desired brand of RICE (100% Broken rice / Non-Basmati rice) as per your requirement and any quantity. Kindly write to us for quotes.

Best price & Quality Assured.

John B Ram, INDIA

addressmymails@gmail.com

Dear All,

We are rice exporter from Pakistan and deal in all varities of rice, with best price, best quality and most importantly in a ethical way..

So Sir if you have any requirment regarding to rice let us know, we will give you the best services.

Hoping a good reply from your side,

Thank You

Regards

Humza Tahir

From : IRFAN NOMAN BERNAS (PVT) LTD

SKYPE: hamza.inb

Cell : +92 302 8221372

FB : https://www.facebook.com/INBRice

COMPANY PROFILE

Irfan Noman Bernas (Pvt.) Ltd., is a joint venture company between “BERNAS” a Malaysian food conglomerate, listed in Kuala Lumpur stock exchange and Irfan Noman Group, Irfan Ahmed Sheikh – Group Chairman and Noman Ahmed Sheikh – C. E. O. are leading businessman in rice Industry. The relationship of Irfan Noman and Bernas is over 26 years

Product & Services: We are specialized in the field of rice procuring, processing, packaging and marketing. We market a series of Pakistani White Rice varieties like

Pakistani Super Kernel Basmati Rice,

Pakistani Basmati PK-385 Rice, PK-386 Rice,

Pakistani D-98 Rice,

Pakistani Long Grain Irri-9 Rice,

Pakistani Long Grain Irri-6 Rice 5%, 25%, 35% & 100% broken and

Blended Varieties

We tailored and designed different brands according to customer’s need.

Rice Plant: INB Rice Mill is equipped with the state of art machinery imported from BUHLER, Germany comprising cleaner, de-stoners, and set of polishers to ensure homogenous whiteness on rice upto 46 Kett along with the 2 most modern color sorter machines Z+4. INB has its own Power Generation, having capacity to process 80,000 metric tons rice per year. The plant is strictly according to ISO-9001:2008 standards and H.A.C.C.P. standards.

Credentials: Our group was awarded best Rice Export Trophy by the President of Pakistan in 1994-1995 since then we are receiving best export trophy from Federation of Pakistan Chamber of Commerce & industry (FPCCI) presented by the President and Prime Ministers of Pakistan in recognition of our untiring efforts to increase rice export business. Our Group Chairman, Mr. Irfan Ahmed Sheikh was also the Chairman of Rice Exporters Association of Pakistan and C. E. O. Noman Ahmed Sheikh both are the recipient of “Best Businessman of the Year Gold Medal Award”.

Certification: INB is the First Company in Pakistan to have H.A.C.C.P certification from U.R.S of U.K. Hazard Analysis Critical Control Point (HACCP) is an internationally accepted methodology to reduce and manage risks associated with food processing. It is a preventive system for food safety that addresses chemical, physical and biological (microbiological) risks. INB have ISO-9001:2008 certified from URS of U.K. INB is also a HALAL certified company.

Percentage Increase in Exports: INB has a turn over of Pak Rs 5.0 billion during the year 2012-2013 as compared to our last year exports of over 4 billion and last year export was over 100,000 metric tons.

1. Dear All,

We are rice exporter from Pakistan and deal in all varities of rice, with best price, best quality and most importantly in a ethical way..

So Sir if you have any requirement regarding to rice let us know, we will give you the best services.

Hoping a good reply from your side,

Thank You

Regards

Humza Tahir

From : IRFAN NOMAN BERNAS (PVT) LTD

SKYPE: hamza.inb

Cell : +92 302 8221372

FB : https://www.facebook.com/INBRice

COMPANY PROFILE

Irfan Noman Bernas (Pvt.) Ltd., is a joint venture company between “BERNAS” a Malaysian food conglomerate, listed in Kuala Lumpur stock exchange and Irfan Noman Group, Irfan Ahmed Sheikh – Group Chairman and Noman Ahmed Sheikh – C. E. O. are leading businessman in rice Industry. The relationship of Irfan Noman and Bernas is over 26 years

Product & Services: We are specialized in the field of rice procuring, processing, packaging and marketing. We market a series of Pakistani White Rice varieties like

Pakistani Super Kernel Basmati Rice,

Pakistani Basmati PK-385 Rice, PK-386 Rice,

Pakistani D-98 Rice,

Pakistani Long Grain Irri-9 Rice,

Pakistani Long Grain Irri-6 Rice 5%, 25%, 35% & 100% broken and

Blended Varieties

We tailored and designed different brands according to customer’s need.

Rice Plant: INB Rice Mill is equipped with the state of art machinery imported from BUHLER, Germany comprising cleaner, de-stoners, and set of polishers to ensure homogenous whiteness on rice upto 46 Kett along with the 2 most modern color sorter machines Z+4. INB has its own Power Generation, having capacity to process 80,000 metric tons rice per year. The plant is strictly according to ISO-9001:2008 standards and H.A.C.C.P. standards.

Credentials: Our group was awarded best Rice Export Trophy by the President of Pakistan in 1994-1995 since then we are receiving best export trophy from Federation of Pakistan Chamber of Commerce & industry (FPCCI) presented by the President and Prime Ministers of Pakistan in recognition of our untiring efforts to increase rice export business. Our Group Chairman, Mr. Irfan Ahmed Sheikh was also the Chairman of Rice Exporters Association of Pakistan and C. E. O. Noman Ahmed Sheikh both are the recipient of “Best Businessman of the Year Gold Medal Award”.

Certification: INB is the First Company in Pakistan to have H.A.C.C.P certification from U.R.S of U.K. Hazard Analysis Critical Control Point (HACCP) is an internationally accepted methodology to reduce and manage risks associated with food processing. It is a preventive system for food safety that addresses chemical, physical and biological (microbiological) risks. INB have ISO-9001:2008 certified from URS of U.K. INB is also a HALAL certified company.

Percentage Increase in Exports: INB has a turn over of Pak Rs 5.0 billion during the year 2012-2013 as compared to our last year exports of over 4 billion and last year export was over 100,000 metric tons.

Thank You

Regards

Dear Sir,

We are processors and exporters of Rice from India. We would like to inquire if you have any requirements for rice. We can supply Par boiled as well as Long grain white rice in specifications of your choice. If interested than contact us. We can supply small as well as large quantities.

I am a direct Mandate to a genuinely renowned Investment Finance Company offering Cash & Asset Backed Financial Instruments on Lease and Sale at the best rates and with the most feasible procedures.

Instruments offered can be put in all forms of trade and can be monetized or discounted for direct funding. For Inquiry contact

Email: jslease.guarantees@gmail.com

Skype: jslease.consults